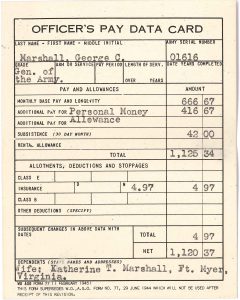

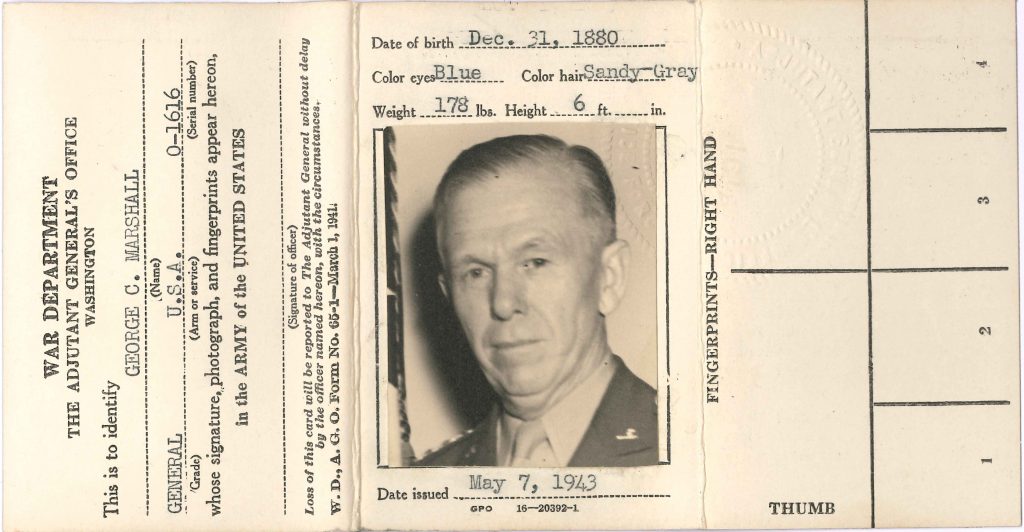

Recently museum and library staff came upon Marshall’s Officer’s Pay Data Card from 1945. It was a form (WD AGO 77) on which all information relative to the individual officer’s pay and allowance, length of service and deductions and allotments was kept. This is different from a pay voucher, and it was required to be kept with an officer’s identification card.

Recently museum and library staff came upon Marshall’s Officer’s Pay Data Card from 1945. It was a form (WD AGO 77) on which all information relative to the individual officer’s pay and allowance, length of service and deductions and allotments was kept. This is different from a pay voucher, and it was required to be kept with an officer’s identification card.

On the pay card you might find these terms:

- Base Pay is the same as a salary received by a civilian employee

- Longevity is the government’s efforts of rewarding officers for long and faithful service in the Army or its reserve components.

- Flight Pay is for officers whose duty requires participation in aerial flight. It’s computed at 50% of their base, longevity, medal, foreign service, etc.

- Overseas pay is for officers who are serving in any of the U.S. possessions or on foreign soil. They receive a 10% increase in pay based on pay only.

- Parachute pay is for officers with parachute troops, attending parachute-jumping school or required to make leaps as part of their duty. They receive a stipend of $100 per month.

According to his pay card, Marshall, as General, made $13,500 annually. With inflation, that would be $179,386 in 2016 dollars, which is on par for an O-10 pay grade.

Marshall would have used these IRS instructions and forms from 1945 to file his taxes since a return had to be filed by every citizen of the United state who had $500 or more gross income in 1945.

The 1040 instructions from 1945 stated that members and veterans of the armed forces and their families should exclude from their income the first $1500 of annual pay for active service, mustering out pay, contributions by the government to monthly family allowances, pensions and disability compensations and interest on adjusted-service bonds. This was in addition to standard or itemized deductions.

Marshall didn’t comment much about taxes, except when it came to post-war military policy and the Marshall Plan. In a speech to the Pittsburgh Chamber of Commerce in 1948 about the Marshall Plan, he said, “There are subtle distinctions among the inconveniences and sacrifices that may be expected to result. Waiting for delivery of a new model car while continuing to drive an old one is an inconvenience. Paying higher taxes than we would wish entails definite sacrifice, as does doing without some scarce goods or articles until there are enough to go around. These are some of the realities to be faced in our daily private lives. These are some of the exactions of leadership. But each of the comprehensive analyses of the problem yet made, and there have been a number, resulted in the same general conclusion that the United States can successfully carry out the proposed program.”